Background of the SEC Settlement

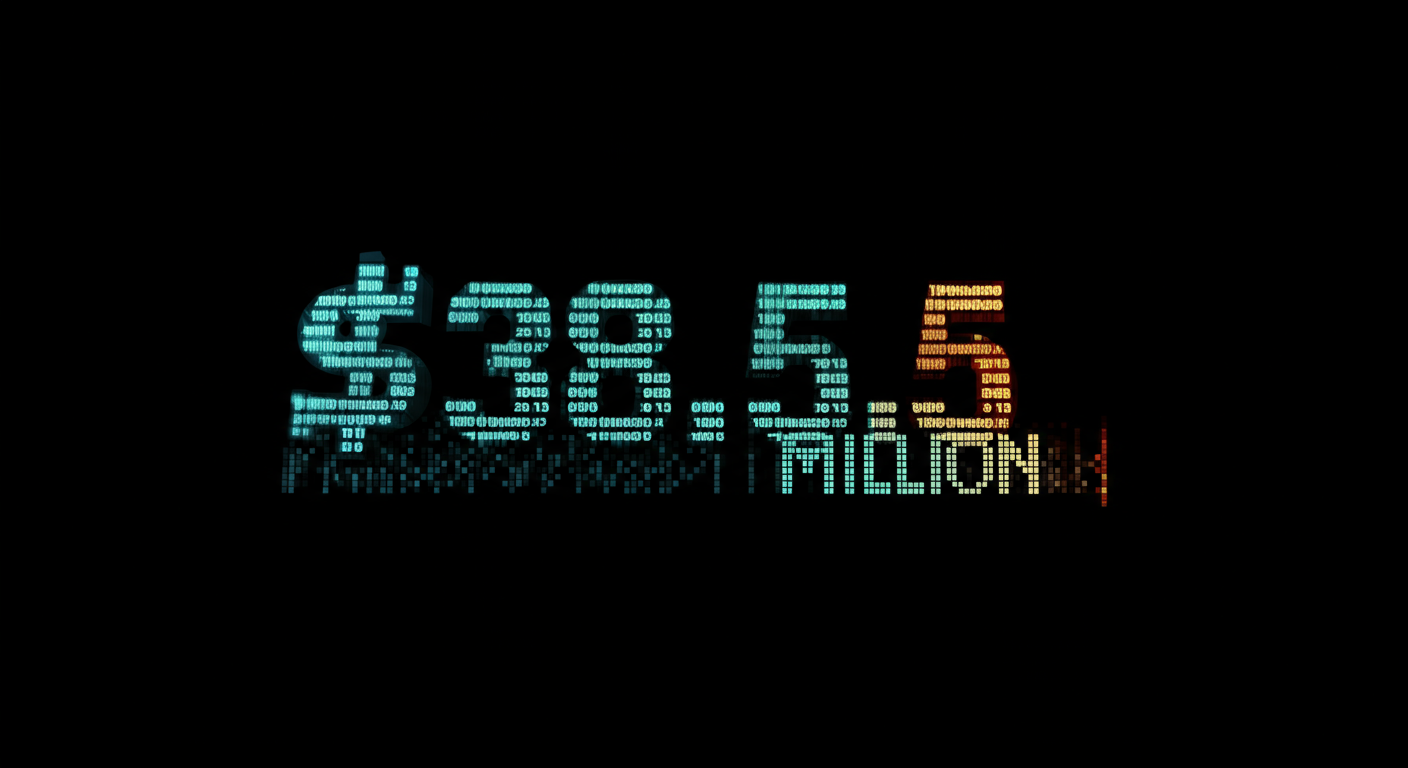

In a significant development within the financial sector, Digital Currency Group and its former subsidiary, Genesis Global Capital, have settled charges with the U.S. Securities and Exchange Commission (SEC) for a considerable amount of $38.5 million. The settlement marks a pivotal moment for these companies, known for their influence in the cryptocurrency domain.

Details of the Allegations

The allegations against Digital Currency Group and Genesis stemmed from actions purportedly infringing on securities regulations. The SEC’s investigation revealed that Genesis Global Capital had engaged in unregistered securities offerings, which is a violation under U.S. securities law. These violations primarily involved the sale of digital asset securities to retail investors without the necessary registration or exemption.

The SEC highlighted that these actions exposed investors to significant risks, leading to the regulatory body’s decisive enforcement action. As part of the settlement, both companies agreed to cease such offerings moving forward, ensuring compliance with applicable securities laws.

Impact on Digital Currency Group

The settlement has substantial implications for the Digital Currency Group. Known for its substantial investments in various blockchain and cryptocurrency ventures, the company is pivotal in shaping the future of digital finance.

While the $38.5 million settlement is considerable, Digital Currency Group has the financial capability to absorb this cost. Furthermore, the agreement with the SEC allows them to put these allegations behind and maintain focus on their core operations and growth strategies.

Genesis Global Capital and Its Future

The charges also pertain directly to Genesis Global Capital, which, before recent events, stood as a prominent player in the digital currency space. Since this settlement, the company has taken measures to rectify past missteps and ensure regulatory compliance.

Genesis has publicly committed to adhering more closely to U.S. securities laws to prevent similar issues in the future. These efforts will involve changes in their management practices and the establishment of more robust compliance frameworks.

SEC’s Role in Cryptocurrency Regulation

The SEC’s action is part of a broader strategy to enforce compliance within the rapidly evolving cryptocurrency market. As digital assets become more mainstream, ensuring investor protection and transparency in trading practices remains a top priority.

- Enhanced Oversight: The SEC has continually emphasized the need for companies dealing in digital assets to comply with established regulations, ensuring a fair and transparent market.

- Investor Protection: Through these enforcement actions, the SEC aims to safeguard retail investors from potential risks associated with unregistered securities offerings.

- Market Integrity: Such settlements reinforce market integrity, critical for building trust among investors and stakeholders.

Financial Market Reactions

The settlement news has understandably stirred reactions across financial markets. Stakeholders and market analysts are closely observing how these developments will impact the cryptocurrency landscape. As regulatory scrutiny increases, companies operating within this realm must prioritize compliance to avoid future conflicts.

Conclusion and Outlook

The resolution between the SEC, Digital Currency Group, and Genesis Global Capital underscores the importance of regulatory adherence in the burgeoning cryptocurrency industry. Moving forward, these companies are expected to implement robust frameworks ensuring compliance and transparent operations.

Such actions not only highlight the SEC’s commitment to regulating emerging financial technologies but also serve as a reminder for firms within the sector to maintain vigilant compliance with securities laws. This landmark settlement is a crucial step towards fostering a secure and trustworthy environment for digital asset investments, paving the way for sustained growth in this dynamic market.

For more insights into the implications of this event, you can explore related topics, such as cryptocurrency regulations and their evolving nature worldwide.